On-chain knowledge exhibits Bitcoin whales with greater than 1k BTC have been the primary sellers within the newest crash, as different cohorts displayed muted exercise.

Bitcoin Spent Output Value Bands Shows Spike From 1k-10k Group

As identified by an analyst in a CryptoQuant post, in contrast to within the earlier declines, the 10-100 BTC and 100-1k BTC cohorts didn’t present any spikes in exercise in the course of the newest crash.

The related indicator right here is the “Spent Output Value Bands” (SOVB). which shows the variety of cash being moved by every worth band within the Bitcoin market.

These “value bands” or teams are divided based mostly on the quantity of cash moved in every transaction on the chain. For instance, the 1k-10k BTC worth band consists of all transfers that concerned between 1k and 10k BTC.

The Spent Output metric for this worth band then particularly measures the whole quantity of Bitcoin that was shifted utilizing transactions of dimension falling on this vary.

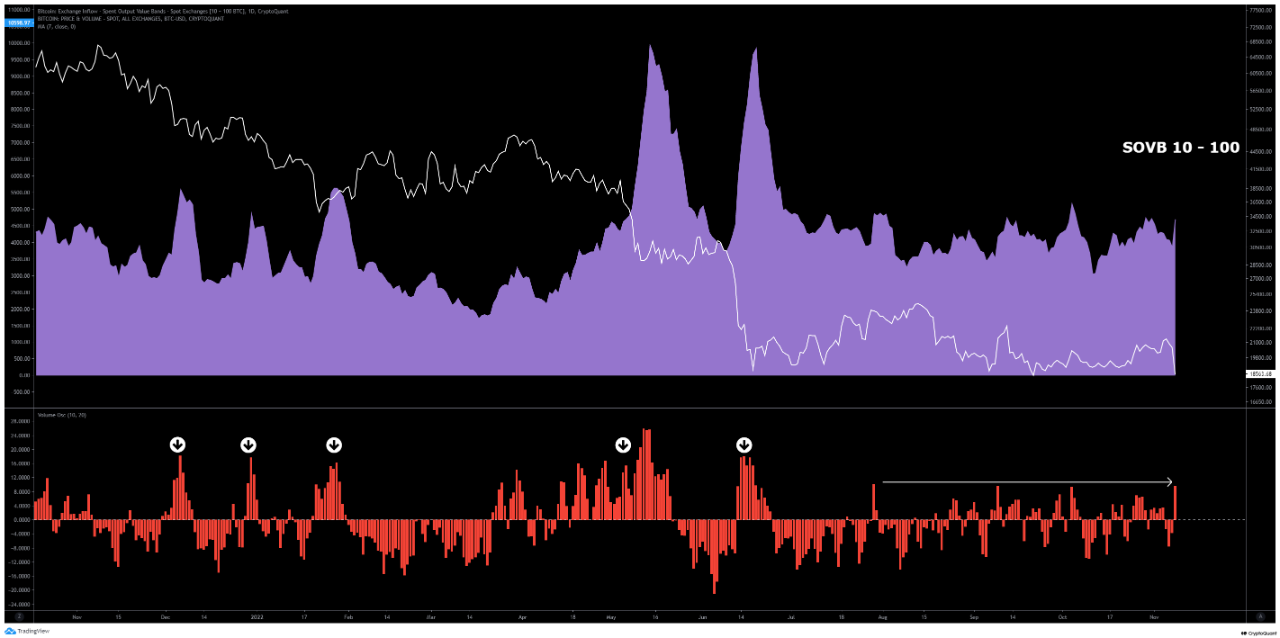

Now, here’s a chart that exhibits the pattern within the Bitcoin SOVB for 10-100 BTC:

The worth of the metric appears to have been regular lately | Source: CryptoQuant

As you may see within the above graph, in the course of the earlier selloffs, the Bitcoin Spent Output chart for the 10-100 BTC worth band spiked up, suggesting that traders with a minimum of 10 to 100 BTC have been closely promoting their cash.

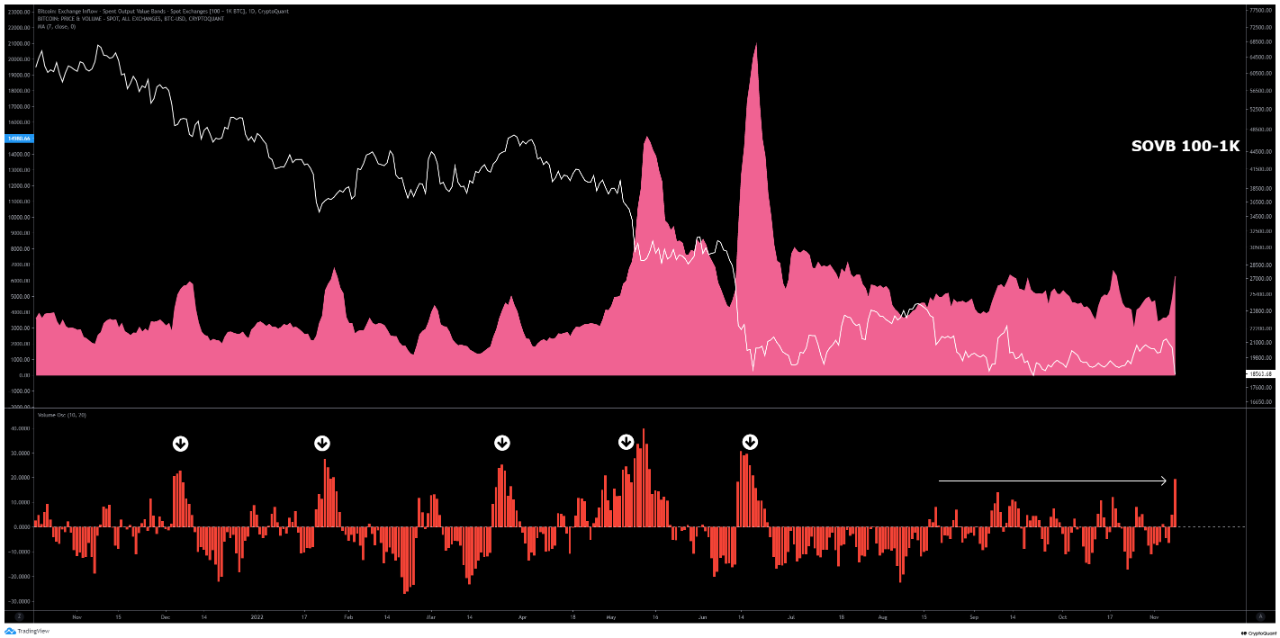

The same pattern was additionally seen for the 100-1k BTC worth band, because the under chart shows.

Looks like this metric has additionally not considerably gone up in current days | Source: CryptoQuant

In probably the most recent crash, nonetheless, whereas there was a spike in these indicators, it was nowhere close to as sharp as within the earlier situations. This means that these worth bands didn’t see a lot dumping this time.

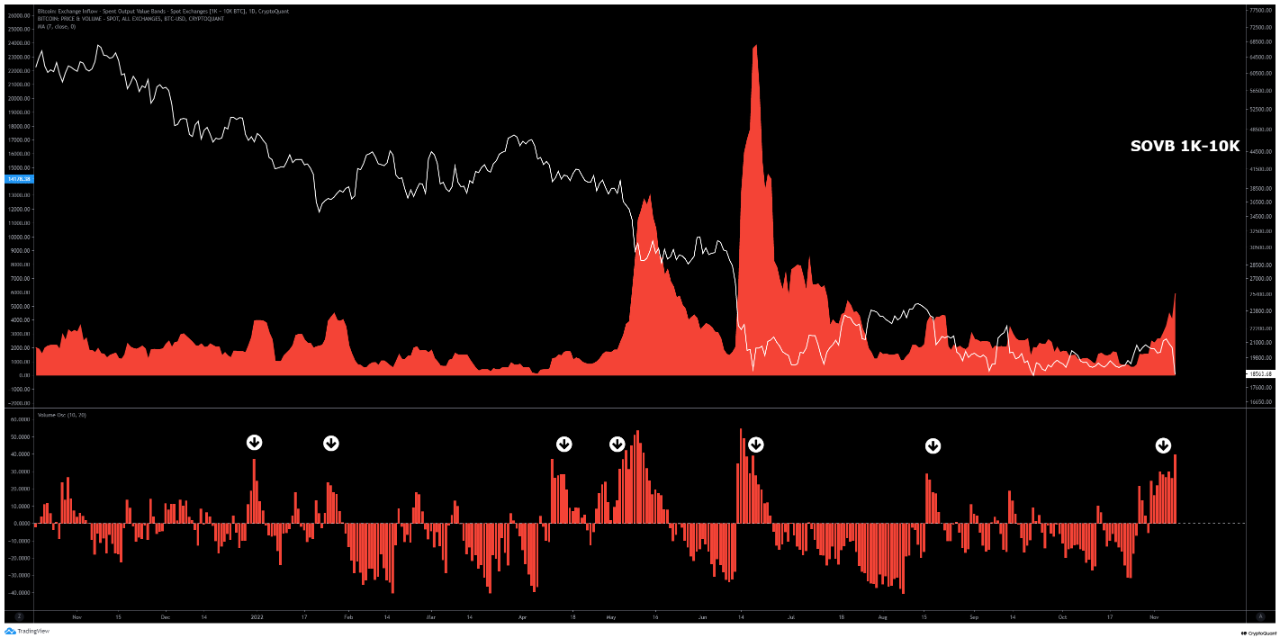

The 1k-10k BTC cohort, although, has confirmed a distinct habits. Below is the Spent Output graph for this worth band.

The indicator has shot up | Source: CryptoQuant

As is obvious from the chart, the 1k-10k BTC worth band registered a considerable amount of motion within the crash, suggesting that transactions value greater than 1k BTC accounted for almost all of the promoting this time round. Such massive transfers belong to the whales, which means that whales drove this crash.

While whale dumping is destructive for the market, the quant notes that the decline within the different two cohorts could possibly be an indication that promoting stress is now virtually exhausted within the Bitcoin market.

BTC Price

At the time of writing, Bitcoin’s price floats round $17.1k, down 15% within the final week.

BTC plummets down | Source: BTCUSD on TradingView

Featured picture from Georg Wolf on Unsplash.com, charts from TradingView.com, CryptoQuant.com