Latest information from Glassnode reveals that round 14% of the Bitcoin provide has been redistributed for the reason that July of this 12 months.

14% Of The Total Bitcoin Supply Has Changed Hands Since July 2022

As per the most recent weekly report from Glassnode, round 20.1% of the provision now has a cost-basis within the historic backside formation vary.

During a Bitcoin backside discovery section, the diminishing investor profitability results in the weaker arms present process a capitulation occasion, which leads to a redistribution of cash happening out there.

In the previous cycles, such a section has began with the crypto dipping beneath the “realized price,” and has lasted whereas the crypto has ranged between this stage and the “balanced price.”

The former is a value mannequin that signifies the cost-basis of the typical investor out there, whereas the latter (the balanced value) is a “fair-value” mannequin for the crypto.

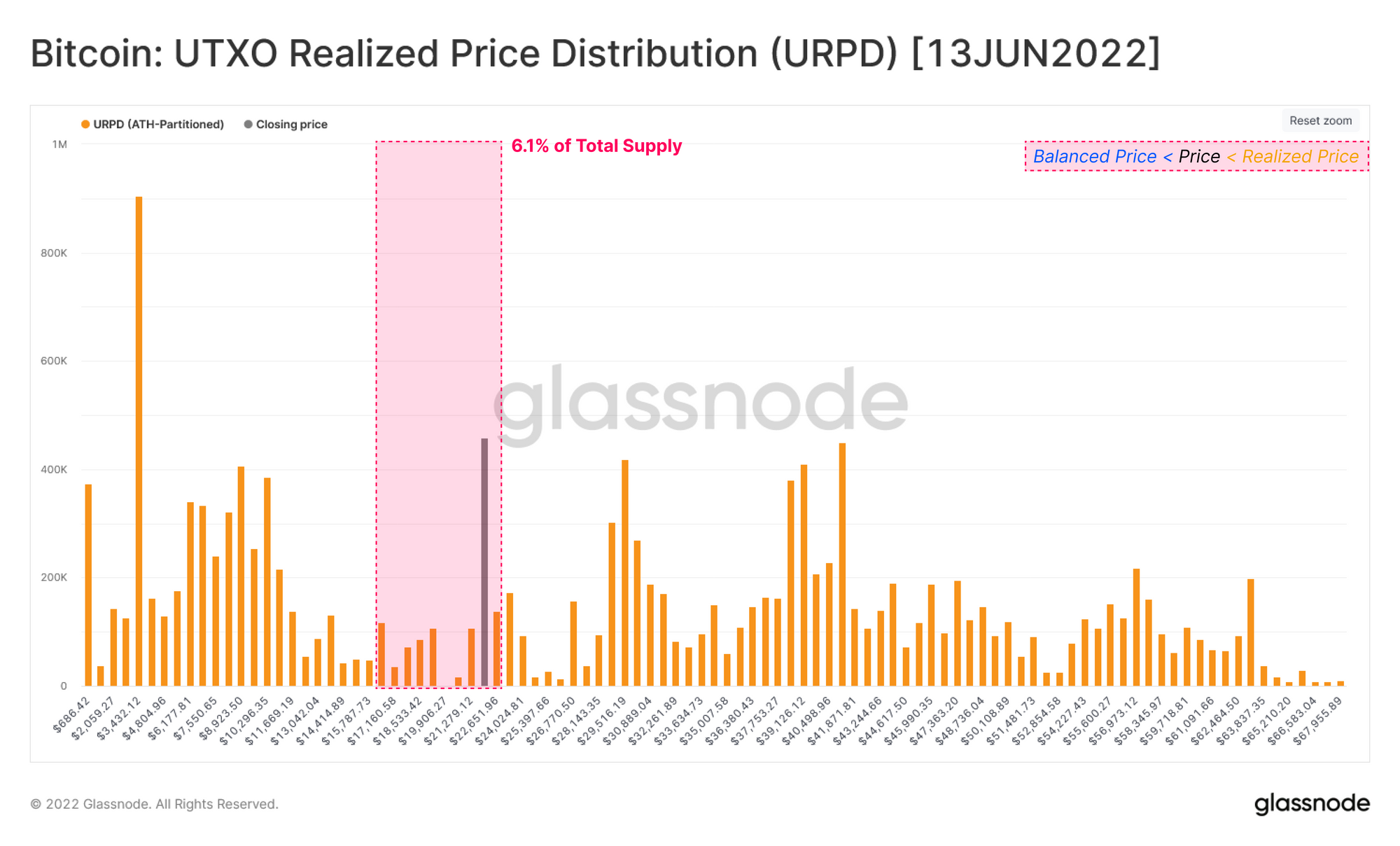

Now, here’s a chart that reveals how the coin distribution within the Bitcoin market appeared like initially of the present backside formation section:

6.1% of the full provide was acquired throughout the vary | Source: Glassnode's The Week Onchain - Week 44, 2022

As you may see within the above graph, earlier than the underside discovery began, round 6.1% of the full provide had its cost-basis between the realized value and the balanced value ranges.

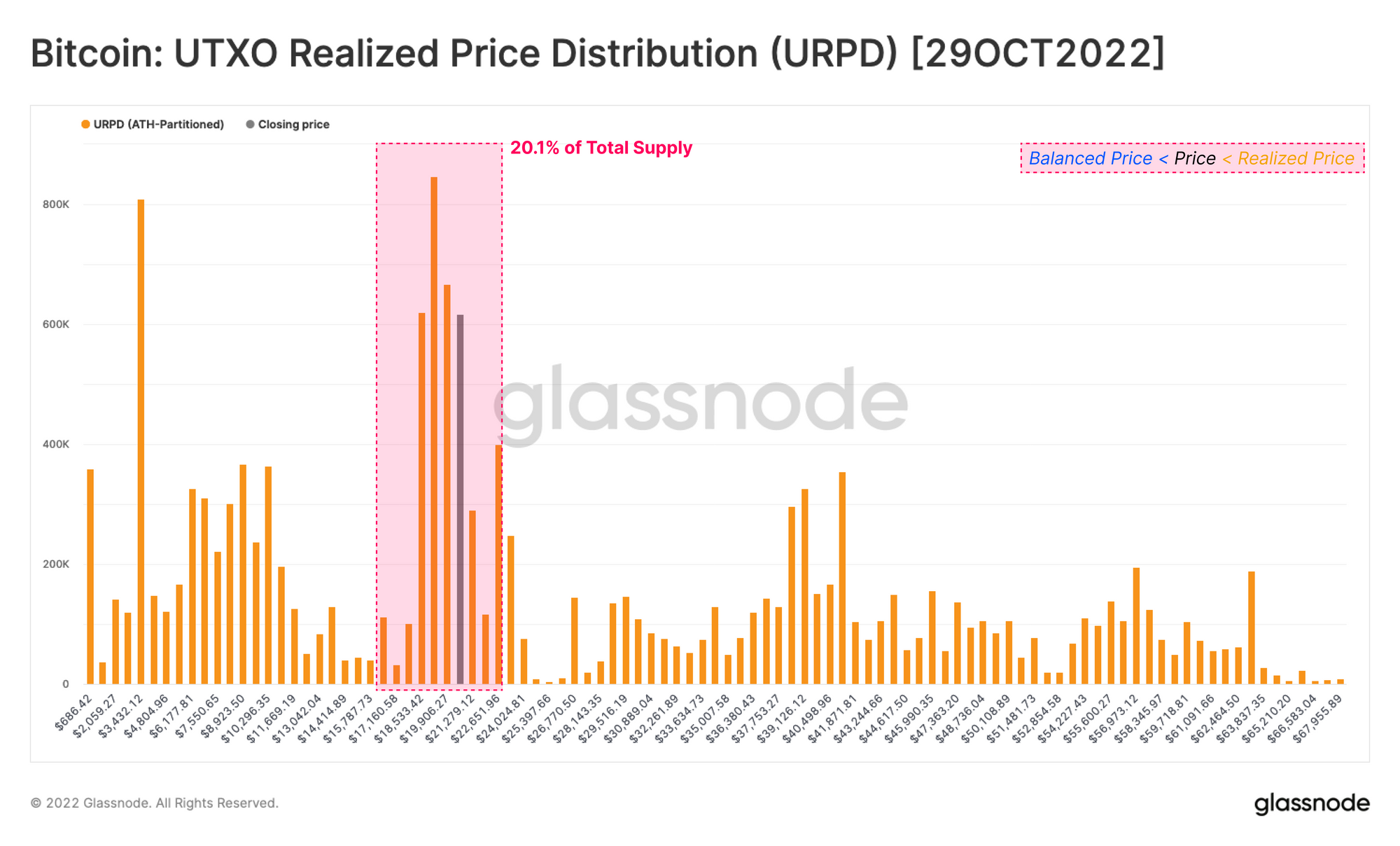

After Bitcoin dipped beneath the realized value and the underside section began, nonetheless, cash naturally began altering arms at these ranges. Following this redistribution, that is how the market appears to be like like:

The new distribution following the underside discovery section | Source: Glassnode's The Week Onchain - Week 44, 2022

20.1% of the full provide now has its cost-basis inside this vary, implying that there was a coin wealth redistribution of round 14% for the reason that month of July.

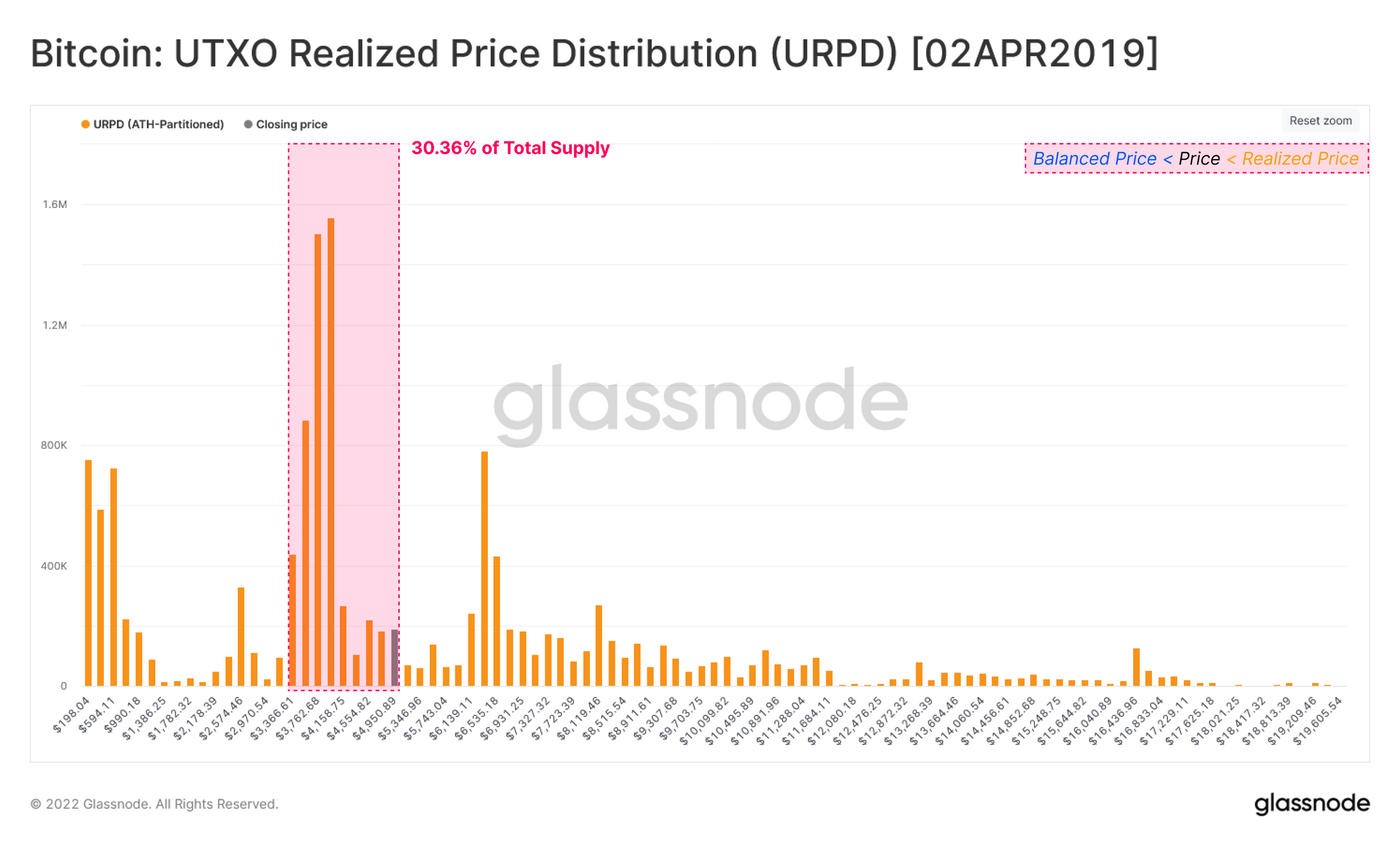

But how does this redistribution evaluate with the earlier cycle? At the beginning of the 2018-19 backside discovery section, round 7.65% of the full provide had its cost-basis throughout the vary.

By the top of the underside discovery section (which was when the coin exited above the realized value), the wealth distribution appeared like this:

The finish of the 2018-19 backside formation section | Source: Glassnode's The Week Onchain - Week 44, 2022

From the graph, it’s obvious that 30.36% of the provision was throughout the vary on the finish, implying that 22.7% of the cash modified arms on this interval.

Clearly, the present cycle hasn’t seen redistribution on this stage but. The report notes that this might recommend the market might have to see additional consolidation earlier than a bear market ground is totally shaped.

BTC Price

At the time of writing, Bitcoin’s price floats round $20.5k, up 7% within the final week.

BTC continues to remain above $20k | Source: BTCUSD on TradingView

Featured picture from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Glassnode.com