Ethereum is lastly coming again to life after an extended interval of consolidation and main the present bullish momentum within the crypto high 10 by market cap. The sluggish worth motion may be boring for many market members, however an professional believes ETH underwent a crucial stage to create a long-lasting backside.

At the time of writing, Ethereum (ETH) trades at $1,550 with sideways motion over at present’s buying and selling session and a 20% revenue within the final seven days. The meme coin data a 30% revenue over the identical interval. In the crypto high 10, ETH’s worth efficiency is simply surpassed by Dogecoin (DOGE).

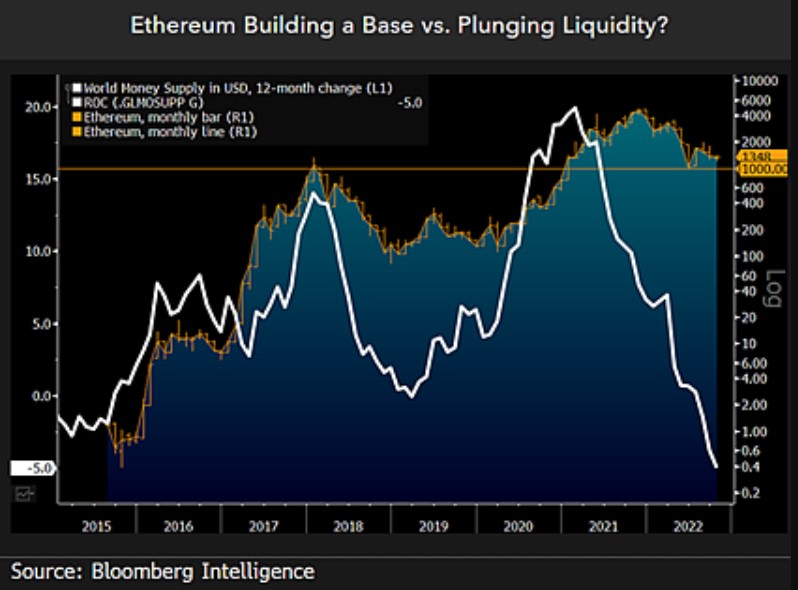

Ethereum Close To Another Multi-Year Bottom?

Senior Commodity Strategist for Bloomberg Intelligence Mike McGlone believes Ethereum’s migration to a Proof-of-Stake (PoS) consensus shall be essential in its long-term appreciation. In the present macroeconomic panorama, excessive power costs and excessive inflation have taken a toll on international markets.

The U.S. Federal Reserve (Fed) has tightened its financial coverage in response to this example. As a end result, Ethereum and different danger property returned to their pre-pandemic ranges.

Still, the second crypto by market cap has been unable to carry the road near its 2017 all-time excessive at round $1,400 to $1,500. As McGlone emphasised, ETH’s worth has prevented additional draw back at these ranges regardless of the Fed implementing its most aggressive technique in forty years.

In that sense, the professional believes Ethereum is cementing its place “at the epicenter of the digitalization of finance.” McGlone wrote:

(…) the No. 2 crypto could also be forming a basis round $1,000 (…). Our graphic exhibits the No.2 crypto probably constructing a base across the 2018 peak, when international liquidity topped out round plus 14%. Ethereum seems at a reduction inside a permanent bull market (…).

The Ultimate Deflationary Asset

If macroeconomic circumstances enhance and the Fed pivots its financial method, Ethereum would possibly lastly reclaim beforehand misplaced territory and steal Bitcoin’s thunder. The professional hints at a quicker decline within the provide of ETH versus BTC.

Rising demand for digital property and a decline in provide will show constructive for the second crypto by market cap. McGlone wrote:

(…) new Ethereum provide shrinking extra rapidly after a protocol change that started shifting cash from circulation in August 2021 and this yr’s merge. The 52-week rate-of-change within the variety of new Ethereum cash from Conmetrics vs. the overall excellent has fallen underneath 2% and is on path to drop under that of Bitcoin.