Something which is all the time attention-grabbing is assessing the mining exercise on Bitcoin, particularly together with what is going on the worth and the broader market.

After all, miners are the group who obtain these freshly minted bitcoins because the blockchain continues to develop. Receiving this income within the native coin of the community means their actions might be indicative.

Something notable is going on for the time being although. The hash fee, which suggests the quantity of computational energy being spent by the Bitcoin community – i.e. the variety of miners – is rising. And it’s rising quite a bit.

But on the identical time, value is falling.

We are printing all-time excessive after all-time excessive in hash fee. The value, nonetheless, has cratered, earlier than buying and selling sideways over the previous couple of months round this $20,000 degree.

This is uncommon. As the chart above reveals, the final time we had a violent crash – May 2021 – the hash fee fell, too. This is pure – once more, the income of those miners is Bitcoin, so why shouldn’t mining exercise drop in response to a giant value drop?

Instead, the hash fee – and the problem of the community – stays excessive. Most individuals say this can be a good factor. And they’re proper – the upper the hash fee, the safer the community. And the safer the community, the more healthy Bitcoin is.

But does this make sense? Let’s have a look at this from an financial perspective. Are miners not promoting as a lot as they need to be? It appears as we crab sideways following this crash, miners are usually not letting up. You might level in direction of Ethereum’s change to proof-of-stake in September as attracting extra miners to Bitcoin, however the dates don’t actually line up.

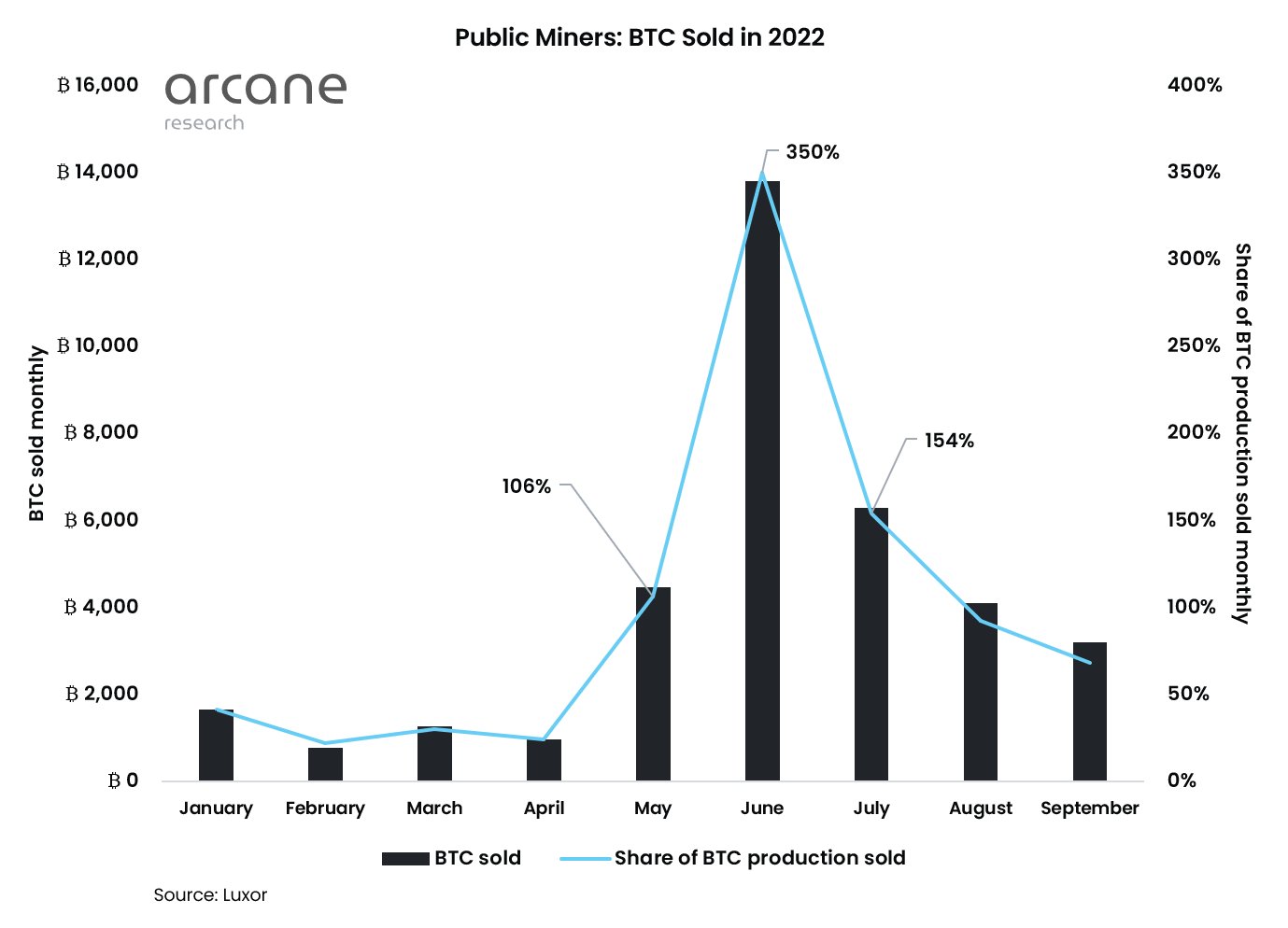

Let’s examine if the miners are promoting (graph through arcane analysis).

After the capitulation in the summertime, they haven’t actually been promoting. But might this variation quickly?

I wrote recently about how I imagine we might be one occasion away from a nasty pink wick for Bitcoin. In wanting on the underlying mining knowledge, I get extra nervous once more. Again, that is removed from sure – and extra a hunch – however allow us to examine the final time we had a hash fee rising with a falling value.

Mid 2018 this occurred…and it wasn’t good.

Let us zoom in somewhat on this time interval – the above chart is a bit hectic. In peering into the 2018 window, we see precisely how this identical pumping value hash fee occurred regardless of the falling in value. And then look what occurred the worth in late 2018.

So that’s worrying. And there are individuals pointing this out as a bearish indicator. But as anybody who follows my evaluation is aware of, I’m not precisely comfy with extrapolating previous Bitcoin cycles to in the present day.

Yes, this occurred in 2018. But have a look at Bitcoin again then. Had you even heard of it? Because many hadn’t – it was nonetheless a distinct segment asset, not but making noise within the trad-fi world. Not to point out, the macro local weather is completely completely different in the present day, with us squarely in a brand new rate of interest paradigm. A degree that ought to by no means be forgotten in previous cycles: none of these cycles occurred whereas we have been within the midst of a wider bear market within the financial system.

But on the identical time, it’s not merely the actual fact this has occurred earlier than. For me, I’m just a bit puzzled that the promoting of miners isn’t a bit increased right here, or why the hash fee is mooning so aggressively.

So, in conclusion, this indicator just isn’t inflicting me to run for the SELL button. But I do like utilizing mining knowledge together with my wider evaluation, and it’s a curious occurring. And as I wrote final week, I do concern that this crab movement round $20,000 might finish with a pink wick. It’s a psychologically essential degree, and as soon as we break exhausting beneath it, there’s not a lot resistance.

There are too many variables within the wider market that might simply go south, and Bitcoin has not given up an excessive amount of because the contagionary wave of the summer time – shares have truly been worse. This underlying mining exercise just isn’t quelling these considerations, even when it’s not accentuating it.