Data exhibits the price of mining Bitcoin has now surged as much as $19.3k, one thing that might spell doom for the miners.

Bitcoin Difficulty Regression Model Shows Cost Of Production Now $19.3k

As per the newest weekly report from Glassnode, the price of BTC manufacturing has gone up not too long ago as a result of hashrate and problem setting new all-time highs.

The “difficulty regression model” is an estimated common value of manufacturing for Bitcoin that bases its worth on the mining difficulty.

This problem is a characteristic of the BTC blockchain that controls how a lot hashes miners might want to make to be able to mine a block on the community.

Whenever the hashrate (the full computing energy linked to the chain) goes up, so does the issue for the reason that community desires to maintain the block manufacturing fee fixed.

The problem regression mannequin doesn’t make use of any elaborate information on mining tools, energy, and different prices that miners face, but it surely merely calculates a median value with the idea that the mining problem already accounts for all these variables in a single quantity.

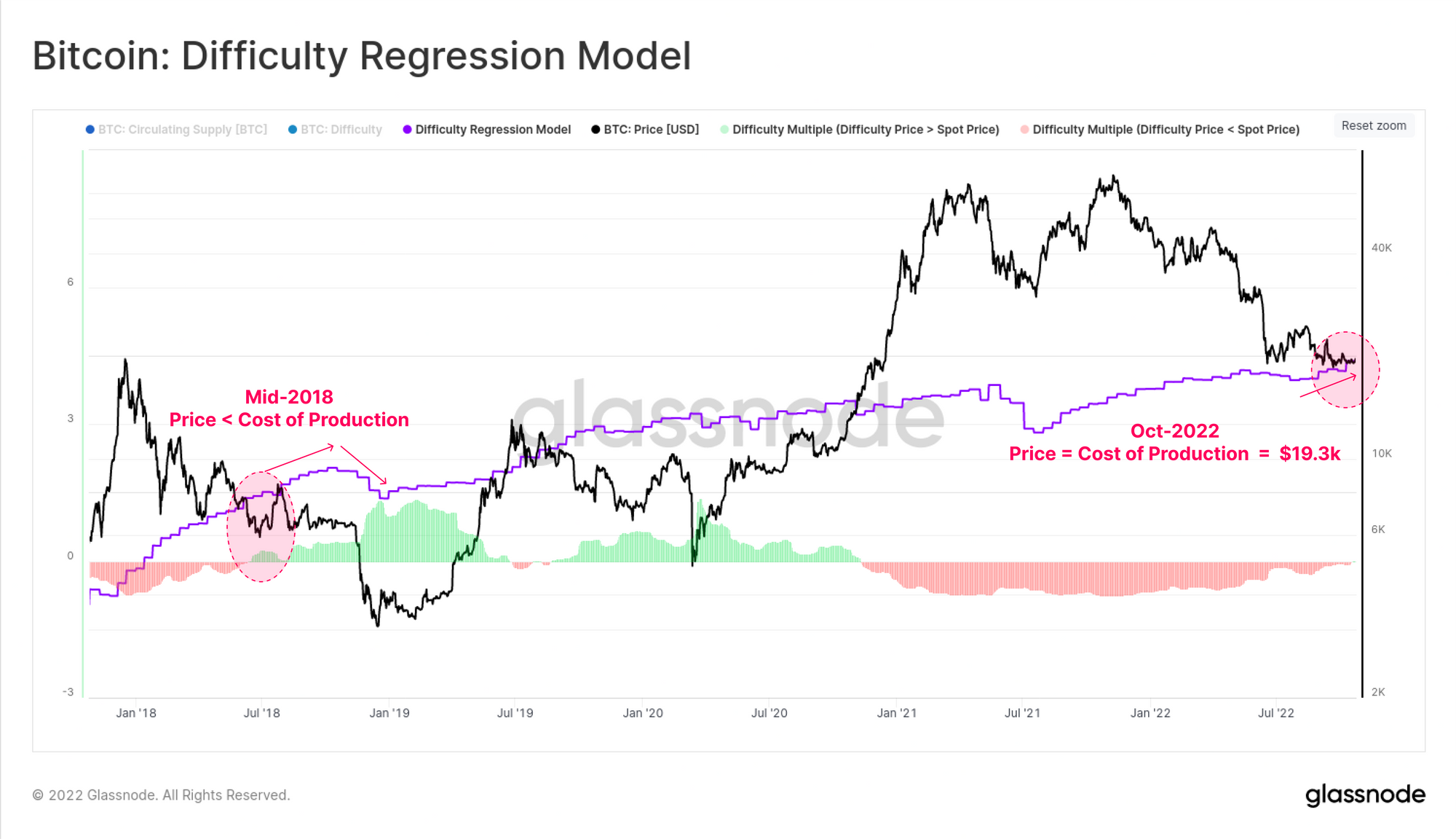

Now, here’s a chart that exhibits the pattern on this Bitcoin value of manufacturing mannequin over the previous couple of years:

The worth of the metric appears to have gone up in current days | Source: Glassnode's The Week Onchain - Week 43, 2022

As you’ll be able to see within the above graph, the Bitcoin problem regression mannequin has elevated in worth throughout the previous couple of weeks.

The cause behind this progress lies within the aggressive rise within the hashrate not too long ago, which has result in an issue explosion within the crypto.

After this improve in the price of manufacturing, miners need to incur a median expense of round $19.3k in the event that they wish to mine 1 BTC.

This worth occurs to be about what the precise value of Bitcoin has been shifting sideways round not too long ago. This signifies that at current, the typical miner can be making little to no revenue, if not taking an outright loss.

The report notes that the final time the price of manufacturing exceeded the value itself was again in the course of 2018, which triggered a miner capitulation that persevered for a lot of months after.

So, if the issue regression mannequin retains rising from right here on, and the BTC value doesn’t discover any enhancements, then the same capitulation occasion may happen once more.

BTC Price

At the time of writing, Bitcoin’s price floats round $19.5k, down 1% within the final week.

(*1*)

Looks like the worth of BTC has surged above the mining manufacturing value for now | Source: BTCUSD on TradingView

Featured picture from mana5280 on Unsplash.com, charts from TradingView.com, Glassnode.com