The U.S. Securities and Exchange Commission (SEC) has been actively probing main Digital property exchanges and companies suppliers in an effort to ship a message to the market. However, a number of experiences have come out suggesting that the fee executives are standing divided over sure rules.

SEC’s new outlook for NFTs?

Financial Times reported that SEC commissioner Hester Peirce has alleged that the US watchdogs have stored the NFT creators and traders unaware of legal guidelines. They don’t have readability about which NFT might qualify as securities.

SEC commissioner recommended that among the non-fungible tokens might be regulated like inventory or bonds forward. While she requested the fee to push extra info across the market rules.

Coingape reported that the fee launched a probe over the Bored Ape Yacht Club (BAYC) father or mother firm Yuga Labs. The fee is checking whether or not the NFT creators have violated the regulation by promoting their Bored Ape collectibles.

However, Hester Peirce talked about that digital collectibles that supply traders the suitable to income streams can come below Securities legal guidelines. She added that tokens which are cut up and bought off out there may land into this class.

Heat amongst fee executives?

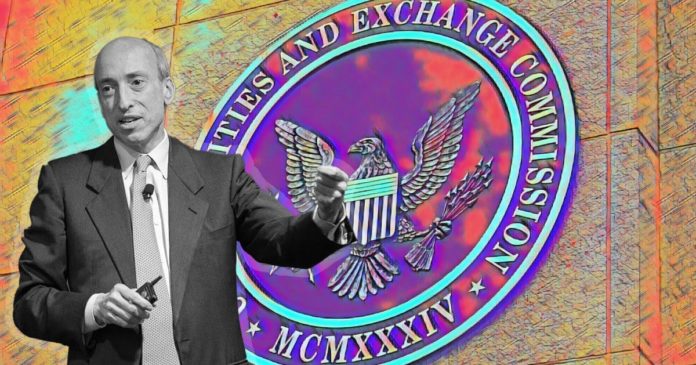

SEC executives have typically fashioned completely different conclusions over crypto rules. Earlier, Coingape reported that the SEC chair Gary Gensler may need violated protocols in the Kardashian settlement case. The SEC enforcement workers accused Gensler of breaching the conduct within the case. He notably hyped the case to benefit from the highlight.

On one hand, the place the SEC commissioner is asking for brand spanking new and improved regulation for the market, the SEC chair has maintained its stance of resisting making new guidelines. He even argued that these current legal guidelines are sufficient for the market.

However, the SEC chair has determined to take the robust enforcement route over the digital asset market. He additionally referred to as it the wild west depicting that each one the platforms ought to register with the regulators.

The offered content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.